Recent Academic Research

The stock discount from implied return distributions, the persistence of input supply shocks, the changing correlations of currencies, and the pre-filing decay of insider alpha

Welcome back to another issue of Recent Academic Research! Let’s get into it.

Implied Stock Return Distribution

Diversification reduces skewness, which investors pay for, but also reduces variance and kurtosis, which investors avoid.

This paper re-evaluates the “diversification discount” (the observation that diversified firms trade at lower valuations than focused ones) by decomposing stock return moments. While prior literature suggests investors discount diversified firms because they offer less “skewness” (upside lottery potential) , this study finds a countervailing effect: diversification also reduces variance and “kurtosis” (tail risk).

Investors typically demand a premium for these risks, so reducing them should theoretically increase firm value. The authors find that diversified firms indeed trade at a discount due to lower skewness, but this discount is significantly mitigated by the concurrent reduction in variance and kurtosis.

Essentially, the market penalizes the loss of upside potential but rewards the reduction in crash risk, leading to a smaller discount than skewness alone would predict.

Shan, Tao, Diversification Discount or Premium? New Insights from Stock Return Moments. Available at SSRN: https://ssrn.com/abstract=6099437 or http://dx.doi.org/10.2139/ssrn.6099437

Insider Trading Alpha

Insider trading alpha is mostly an illusion of transaction-date backtesting.

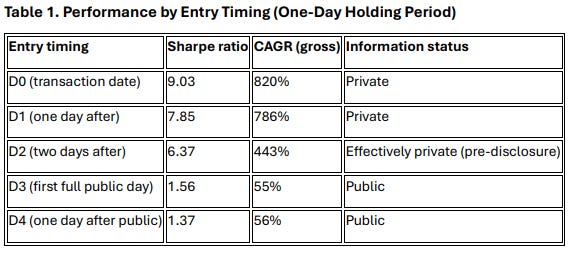

Practitioner backtests often show massive abnormal returns for insider trading strategies, but this paper argues these results are largely due to “look-ahead bias” regarding trade entry. By separating the transaction date (when the insider trades) from the filing date (when the Form 4 is public), the authors track how alpha decays.

They find that 70–80% of the abnormal return occurs between the transaction and the filing (a window where the information is legally private). Strategies that wait to trade until the public filing date generate negligible alpha, with Sharpe ratios collapsing from over 9.0 to 1.5.

The market efficiently incorporates the private information via order flow before the regulatory disclosure ever hits the tape.

Ozlen, Omer and Batumoglu, Ozkan, The Death of Insider Trading Alpha: Most Returns Occur Before Public Disclosure (December 25, 2025). Available at SSRN: https://ssrn.com/abstract=5966834 or http://dx.doi.org/10.2139/ssrn.5966834

Volatility & Currency Correlations

Major currency pairs synchronize during volatility, while precious metals decouple.

This study analyzes ten years of weekly data (2015–2024) to quantify how volatility regimes alter asset correlations. The key finding is that correlation is dynamic, not static: during high-volatility regimes, major USD currency pairs (like EUR/USD and GBP/USD) exhibit significantly stronger positive correlations, moving in lockstep due to the dollar’s role as a global reserve asset.

Conversely, gold and silver act as conditional safe havens. In low-volatility environments, metals may correlate with commodities, but during market stress, their correlation with USD pairs drops to near zero or becomes negative.

Arefin, Shah Shamsul, Safe-Haven Assets Under Volatility Regimes: Evidence from USD Currency Pairs and Precious Metals (2015-2024) (January 12, 2025). Available at SSRN: https://ssrn.com/abstract=5995574 or http://dx.doi.org/10.2139/ssrn.5995574

Supply Side Inflation

Input production shocks cause persistent inflation and output loss, unlike transient transportation shocks.

This research distinguishes between two specific supply-side disruptions often conflated during the post-COVID inflation surge: transportation shocks (shipping delays) and input production shocks (shortages of specific goods).

Using a structural vector autoregression (SVAR) model, the authors find these shocks have starkly different impacts. Transportation shocks spike costs temporarily but fade within two years, with limited pass-through to core inflation. In contrast, input production shocks (like those seen during the pandemic) cause deeper, more persistent contractions in industrial production and sustained increases in producer and consumer prices.

Crucially, the Fed appears to “look through” transportation shocks but tightens rates in response to the persistent inflation generated by input shortages.

Marx, Magali and Grosse Steffen, Christoph and Elsayed, Moaz, Global Sectoral Supply Shocks, Inflation, and Monetary Policy (December 22, 2025). Banque de France Working Paper No. 1026, Available at SSRN: https://ssrn.com/abstract=6101849 or http://dx.doi.org/10.2139/ssrn.6101849

Feedback

Thank you for reading this week’s edition of Recent Academic Research. Remember to fill out the poll to let me know which paper was your favorite and like the post if you enjoyed it.

Feel free to follow up with any questions, comments, or ideas for the future!

Disclaimer

The content provided in this newsletter, "Alpha in Academia," is for informational and educational purposes only. It should not be construed as financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities or financial instruments. Past performance is not indicative of future results. The financial markets involve risks, and readers should conduct their own research and consult with qualified financial advisors before making any investment decisions.

The interpretations, opinions, and analyses presented herein are those of the author and do not necessarily reflect the views of the original researchers, their institutions, or the full implications of the cited academic papers. While every effort is made to accurately represent the research discussed, readers should be aware that the summaries and interpretations may not capture the full scope or nuances of the original studies. The information contained in this newsletter is believed to be accurate and reliable at the time of publication, but accuracy and completeness cannot be guaranteed. The author and publisher accept no liability for any loss or damage resulting from reliance on the information provided.

This newsletter may contain links to external websites or resources. The author is not responsible for the content, accuracy, or reliability of these external sources.

By subscribing to or reading this newsletter, you acknowledge that you have read and understood this disclaimer and agree to hold the author and publisher harmless from any liability that may arise from your use of the information contained herein.