Recent Academic Research

The waning influence of US valuations, the instability of the stock-bond hedge, and the geopolitical distortion of short selling

Welcome back to another issue of Recent Academic Research! Let’s get into it.

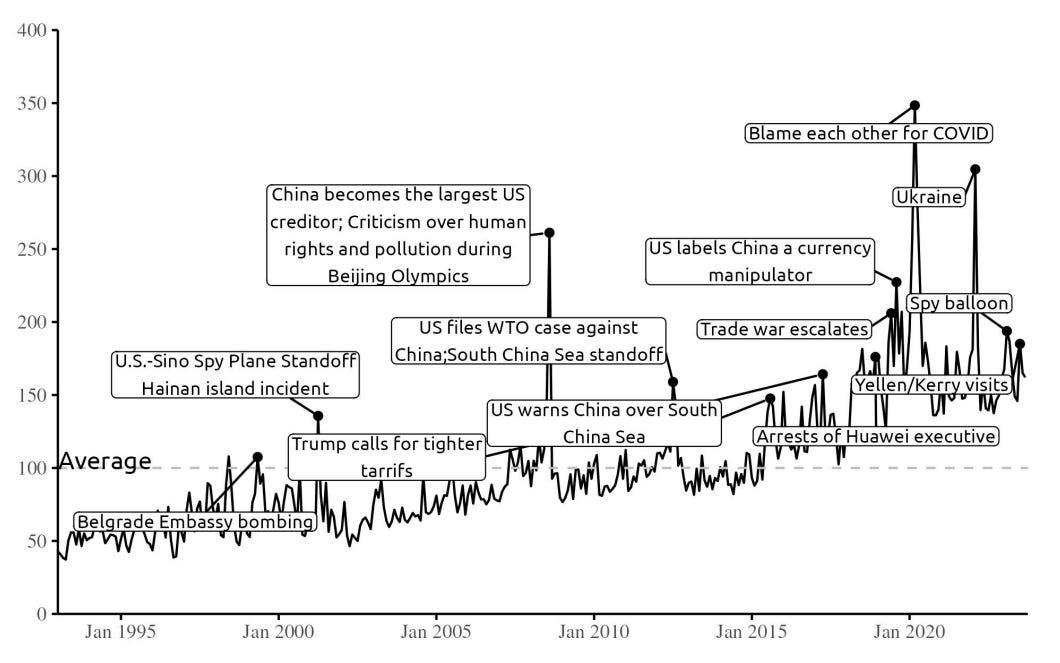

Short Selling during US-China Tensions

When geopolitical tensions rise, activist short sellers switch from forensic detectives to sentiment traders, launching low-quality attacks that trigger sharp but temporary price drops.

This paper examines how US-China tensions distort the incentives of activist short sellers. During periods of high political friction, short sellers aggressively target Chinese firms, yet they rarely produce new, independent research. Instead, they pile into existing targets with “follow-up” reports that repackage public information using highly negative rhetoric.

The market bites, sending prices down sharply (over 22 percent more than normal), but these drops are fleeting as most of the decline reverses within a year. Crucially, fraud allegations made during these tension peaks are significantly less likely to be verified later. Investors should be wary of short reports released during political storms, as short sellers “exploit prevailing political sentiment”.

Hines, Ben and Liu, Claire and Qiu, Yancheng and Westerholm, P. Joakim, Trading on Tension: Geopolitical Motives and Market Distortions (June 01, 2025). Available at SSRN: https://ssrn.com/abstract=5311288 or http://dx.doi.org/10.2139/ssrn.5311288

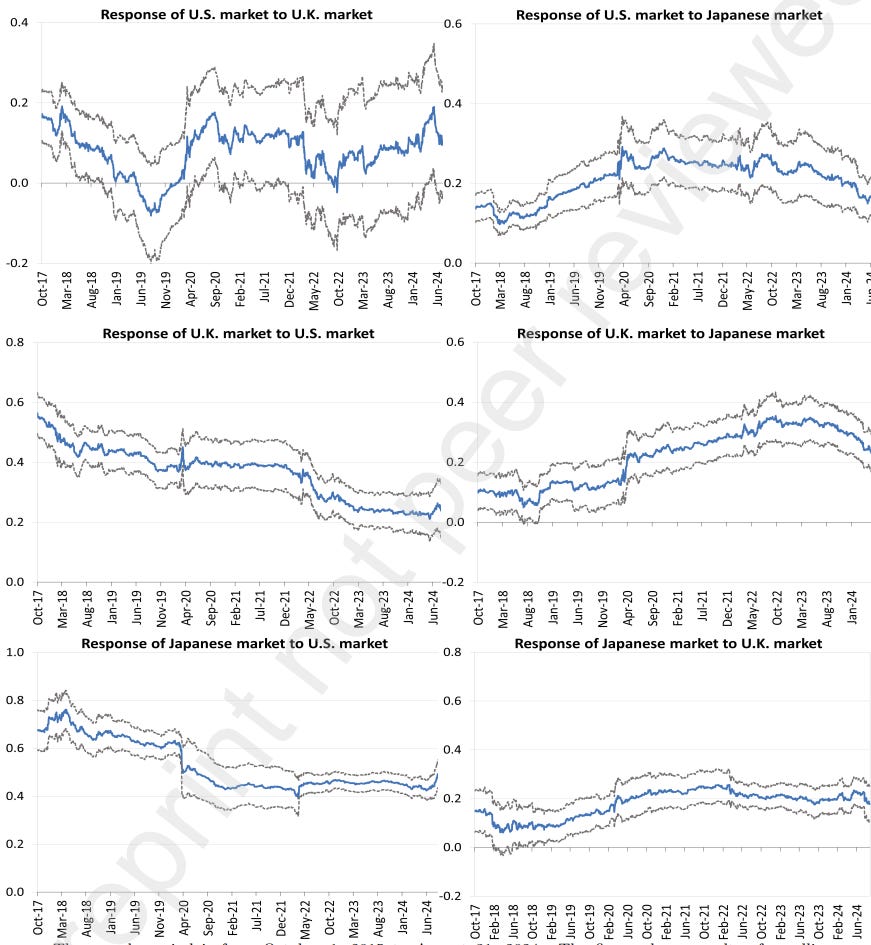

Causality in Global Stock Markets

As US stock valuations swelled relative to peers, their ability to move foreign markets dropped significantly, suggesting global investors eventually tune out expensive noise.

Using intraday data from 2015 to 2024, the authors tackle the classic “who moves whom” question in global markets. They find that while the US, UK, and Japan all influence each other, the transmission of shocks from the US to the others has weakened dramatically, with the UK’s response to US moves falling by roughly 55 percent.

The culprit appears to be the relative price tag of the US market. As US valuations (measured by the CAPE ratio) climbed higher than those abroad, its price movements became “noisier” (less about shared economic fundamentals and more about US-specific exuberance) causing foreign markets to pay less attention.

This decoupling suggests that international diversification might offer better shielding than previously thought when the leading market is expensive. The authors conclude that “relative overvaluation... made its price movements less informative

Kurov, Alexander and Olson, Eric and Olson, Eric and Wolfe, Marketa, Contemporaneous Causality between Global Stock Markets 1. Available at SSRN: https://ssrn.com/abstract=5938629 or http://dx.doi.org/10.2139/ssrn.5938629

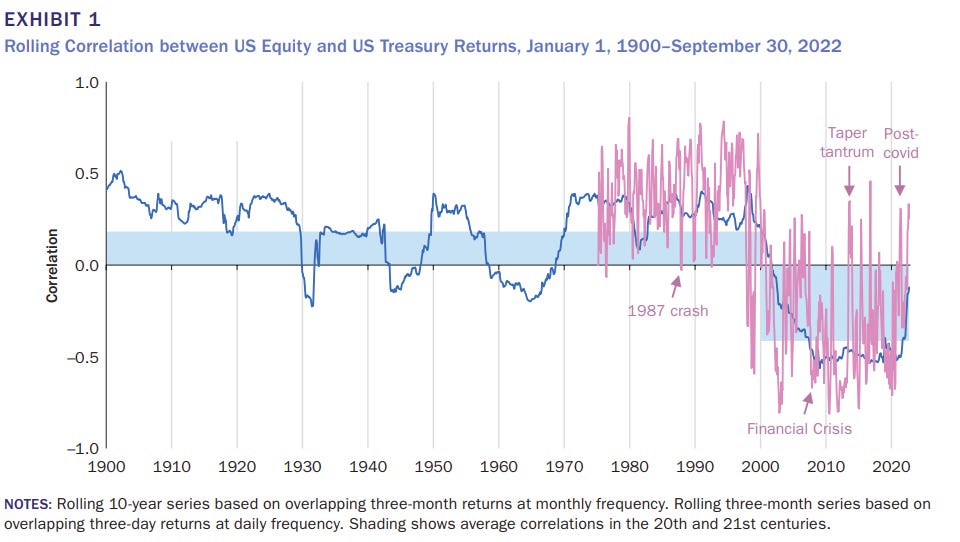

Factors affecting Stock-Bond Correlation

The “safe haven” inverse relationship between stocks and bonds is a regime-dependent anomaly, not a rule, often vanishing exactly when inflation spikes.

Analyzing nearly 30 years of data, this study dissects the unstable correlation between equity and bond prices. While the “risk-off” negative correlation (stocks down, bonds up) defined the post-2000 era, the authors show this relationship flips positive during periods of high inflation or aggressive monetary tightening.

When inflation is the dominant driver, it batters both asset classes simultaneously, breaking the diversification investors rely on. Conversely, strong economic growth tends to lift both assets. This instability is critical for anyone relying on the traditional 60/40 portfolio to smooth out volatility, as the “correlation... could change from positive to negative”.

Dimech, Maria and Audrin, Tanti, Factors Affecting the Bond-Equity Correlation (January 06, 2025). Central Bank of Malta Research Other Studies 01/2025, Available at SSRN: https://ssrn.com/abstract=5936176 or http://dx.doi.org/10.2139/ssrn.5936176

Feedback

Thank you for reading this week’s edition of Recent Academic Research. Remember to fill out the poll to let me know which paper was your favorite and like the post if you enjoyed it.

Feel free to follow up with any questions, comments, or ideas for the future!

Disclaimer

The content provided in this newsletter, "Alpha in Academia," is for informational and educational purposes only. It should not be construed as financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities or financial instruments. Past performance is not indicative of future results. The financial markets involve risks, and readers should conduct their own research and consult with qualified financial advisors before making any investment decisions.

The interpretations, opinions, and analyses presented herein are those of the author and do not necessarily reflect the views of the original researchers, their institutions, or the full implications of the cited academic papers. While every effort is made to accurately represent the research discussed, readers should be aware that the summaries and interpretations may not capture the full scope or nuances of the original studies. The information contained in this newsletter is believed to be accurate and reliable at the time of publication, but accuracy and completeness cannot be guaranteed. The author and publisher accept no liability for any loss or damage resulting from reliance on the information provided.

This newsletter may contain links to external websites or resources. The author is not responsible for the content, accuracy, or reliability of these external sources.

By subscribing to or reading this newsletter, you acknowledge that you have read and understood this disclaimer and agree to hold the author and publisher harmless from any liability that may arise from your use of the information contained herein.

The shift from forensic short selling to sentiment-driven attacks during tensions periods is fascinating. What caught my eye is the 22% price drop that mostly reverses within a year, suggesting markets eventually distinguish between legitimate fraud discoveries and politically-timed noise. This has huge implications for institutional investors trying to separate signal from geopolitcal theater. I've seen similar dynamics in emerging market debt where political headlines trigger selloffs that fundmentals don't justify. The real danger is how this erodes the informational role short sellers normally play.