Recent Academic Research

The visual edge in art valuation, the weekday rhythm of oil fear, the fading crypto hedge, and the hidden distortion in bond benchmarks

Welcome back to another issue of Recent Academic Research! Let’s get into it.

Fear Gauges and Oil Futures

The “fear gauge” bleeds into oil markets, but the bleeding stops on Mondays.

This paper dissects the transmission of volatility shocks from US and European equity markets to crude and refined oil futures.

Using a dynamic connectedness framework, the authors find the link is strong but highly specific. US fear measured by the VIX hits WTI crude, while “volatility-of-volatility” indices (like VVIX) hammer gasoil markets with tail risk.

The most striking finding is the “weekday pattern” where volatility spillovers are systematically suppressed on Mondays and intensify on Fridays, creating a predictable calendar rhythm to risk.

Conlon, Thomas and Corbet, Shaen and Muñiz, José Antonio, Fear Gauges and Oil Futures: Weekday Patterns in Volatility Spillovers (December 30, 2025). Available at SSRN: https://ssrn.com/abstract=5995714 or http://dx.doi.org/10.2139/ssrn.5995714

Deep Learning & Art Valuation

Machines can finally price beauty, but only when the market is flying blind.

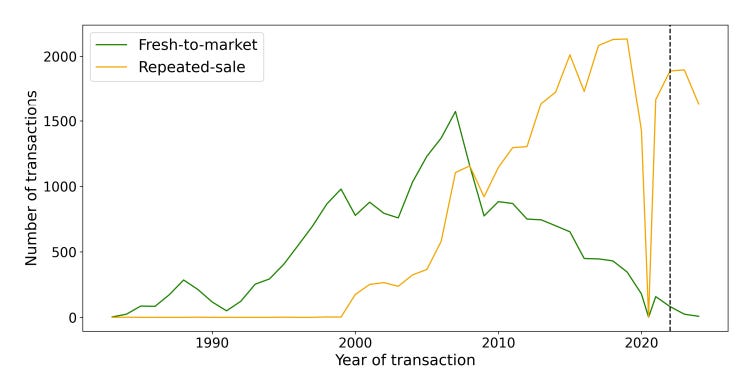

This study benchmarks deep learning against traditional hedonic models to value art, a famously illiquid and subjective asset class. By fusing tabular data like artist and medium with visual embeddings extracted from images via neural networks, the researchers find that algorithms attend to compositional and stylistic cues normally reserved for human experts.

The results reveal a sharp dichotomy. For “repeated sales” with a price history, the machine adds little value because the past price is simply too dominant. However, for “fresh-to-market” works with no sales record, the visual model provides a significant edge by effectively substituting for the missing history.

This matters because it identifies exactly where AI offers an economic edge, and the authors state that “visual embeddings provide a distinct and economically meaningful contribution.”

Mei, Jianping and Mei, Jianping and Moses, Michael and Wàlty, Jan and Yang, Yucheng and Mei, Jianping, Deep Learning for Art Market Valuation (December 28, 2025). Swiss Finance Institute Research Paper No. 25-110, Available at SSRN: https://ssrn.com/abstract=5988754 or http://dx.doi.org/10.2139/ssrn.5988754

Crypto Adoption & Correlation

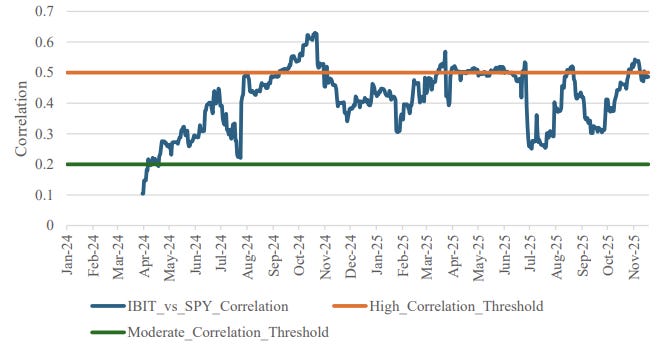

Institutional investors are piling into Bitcoin just as its main selling point is vanishing.

The narrative that Bitcoin is an uncorrelated store of value is colliding with the reality of institutional adoption. Analyzing the first wave of 13F filings for Bitcoin ETFs, the author finds that while endowments and pension funds are entering with tactical discipline, the market structure is shifting under their feet. The rolling correlation between Bitcoin ETFs and the S&P 500 spiked from 0.10 to 0.49 in just two years, a fivefold increase.

This integration suggests that as crypto goes mainstream, it is losing its unique hedging properties.

Investors buying now may be purchasing a high-beta tech proxy rather than the portfolio diversifier they were promised. “The investment thesis... is evolving concurrently with their adoption.”

Krause, David, The Institutional Crypto Bet: Are Early Adopters Buying at the Wrong Time? (December 01, 2025). Available at SSRN: https://ssrn.com/abstract=5841302 or http://dx.doi.org/10.2139/ssrn.5841302

Distortions in Corporate Bond Market

A hidden timing mismatch in corporate bond reporting is systematically distorting the closing prices used by the world’s largest index funds.

In the investment-grade corporate bond market, trades are often negotiated intraday as a spread to Treasuries but “spotted” or priced at the 4:00 PM close. This paper reveals that these “Delayed Treasury Spot” trades account for nearly a quarter of closing volume yet report stale credit spreads agreed upon hours earlier.

The result is a mechanical distortion averaging 19 basis points in price that pollutes the closing price. Because these trades are indistinguishable in public data, this stale information bleeds into the official benchmarks produced by major providers. For investors, it means the close is often a mirage that blends current interest rates with outdated credit risk.

Rapp, Andreas C. and Shin, Sean Seunghun and Zhou, Xing (Alex) and Zhu, Qifei, When Delayed Spotting Meets Delayed Reporting: Distortions in the Corporate Bond Index Close (December 30, 2025). Available at SSRN: https://ssrn.com/abstract=5986474 or http://dx.doi.org/10.2139/ssrn.5986474

Feedback

Thank you for reading this week’s edition of Recent Academic Research. Remember to fill out the poll to let me know which paper was your favorite and like the post if you enjoyed it.

Feel free to follow up with any questions, comments, or ideas for the future!

Disclaimer

The content provided in this newsletter, "Alpha in Academia," is for informational and educational purposes only. It should not be construed as financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities or financial instruments. Past performance is not indicative of future results. The financial markets involve risks, and readers should conduct their own research and consult with qualified financial advisors before making any investment decisions.

The interpretations, opinions, and analyses presented herein are those of the author and do not necessarily reflect the views of the original researchers, their institutions, or the full implications of the cited academic papers. While every effort is made to accurately represent the research discussed, readers should be aware that the summaries and interpretations may not capture the full scope or nuances of the original studies. The information contained in this newsletter is believed to be accurate and reliable at the time of publication, but accuracy and completeness cannot be guaranteed. The author and publisher accept no liability for any loss or damage resulting from reliance on the information provided.

This newsletter may contain links to external websites or resources. The author is not responsible for the content, accuracy, or reliability of these external sources.

By subscribing to or reading this newsletter, you acknowledge that you have read and understood this disclaimer and agree to hold the author and publisher harmless from any liability that may arise from your use of the information contained herein.