Recent Academic Research

The golden ratio equilibrium, the optimization trap in Chinese sectors, the regime-dependent REIT, and the toxic feedback loop of AI and debt.

Welcome back to another issue of Recent Academic Research! Let’s get into it.

The Link Between AI and Private Equity

The next financial crisis may emerge from a feedback loop between concentrated AI valuations and the highly leveraged private equity sector.

Systemic risk is usually analyzed in silos with credit analysts looking at loan defaults and equity analysts watching valuations. This paper argues that the U.S. economy currently faces a dual fragility where the extreme concentration in AI-linked megacaps is structurally tied to the $1.5 trillion leveraged loan market.

The mechanism is a feedback loop where a shock to AI stock valuations widens credit spreads which then triggers refinancing failures among private-equity-backed firms. These defaults subsequently force a contraction in corporate IT spending (a key revenue source for the AI giants) which further depresses equity prices.

Modeling this interaction reveals that traditional risk assessments vastly underestimate the severity of a correction because they ignore how credit stress can amplify an equity drawdown into a broader liquidity event. This “interaction creates a dual-sided systemic risk”.

Ali, Syed Murtaza, The Link between the Use of Leveraged Buyouts and the AI Market Bubble and Its Implications for the US Economy(December 16, 2025). Available at SSRN: https://ssrn.com/abstract=5929915

Regimes for REIT Allocation

Public real estate is not a redundant asset class if you account for the market’s tendency to switch between distinct volatility regimes.

Standard linear models often suggest that REITs offer little diversification benefit once you own small-cap and value stocks. However this research demonstrates that such models fail because they average returns across vastly different market states. By employing a Markov-switching framework the authors identify three distinct regimes (bull, crash, and volatile) and find that optimal allocations to real estate should vary wildly depending on the current state.

In stable bull markets small-value stocks are superior but in high-volatility regimes REITs become essential for their inflation-hedging properties and distinct correlation structure. The study proves that a “set it and forget it” linear allocation leaves money on the table compared to a dynamic approach that respects the changing nature of risk. The authors confirm that “REITs serve as a distinct and state-contingent source of diversification”.

Guidolin, Massimo and Liang, Mingwei and Petrova, Milena, The Importance of Considering Regimes in Long-term Asset Allocation to Real Estate (December 30, 2025). BAFFI Centre Research Paper No. 263, Available at SSRN: https://ssrn.com/abstract=6075106

Smart Beta in Chinese Stocks

In Chinese sector indices, complex optimization models collapse under their own weight while simple variance-based heuristics thrive.

The “optimization paradox” suggests that sophisticated portfolio theories often fail in practice because they require precise return forecasts that are impossible to generate consistently. This comprehensive backtest of 40 Chinese sector indices over fourteen years confirms that improved mathematical complexity actually degrades performance in emerging markets.

The researchers find that a simple Inverse Variance strategy (weighting assets by the inverse of their volatility) dominates Markowitz mean-variance optimization across almost every metric including total return and maximum drawdown.

The complex models suffer because estimation errors in expected returns act as leverage for bad allocation decisions. By ignoring return predictions entirely and focusing solely on risk reduction the simpler strategies avoid “optimizing” on noise. The “Inverse Variance strategy consistently excels by avoiding unstable return forecasts”.

Sun, Zhenkuan and Zhang, Yugui and An, Yulian, On the Efficacy of Smart Beta Strategies for Chinese Sector Indices (December 20, 2025). Available at SSRN: https://ssrn.com/abstract=5949434

Golden Ratio in Investing

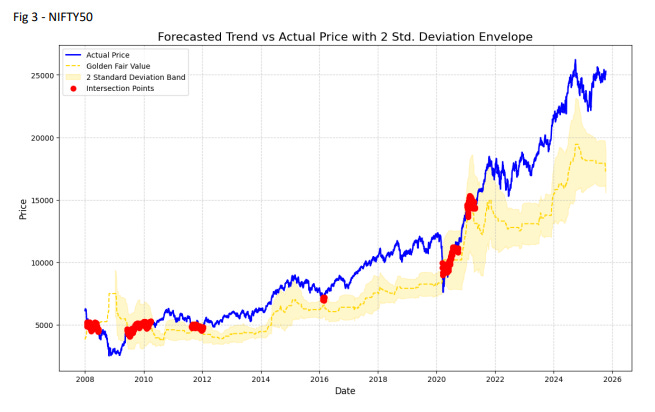

A novel indicator combines the Golden Ratio with 52-week ranges to pinpoint market equilibrium more accurately than traditional trend tools.

Markets spend the majority of their time correcting or consolidating rather than trending which makes improved detection of support levels critical for preserving capital. This paper introduces the “Golden Fair Value” (GFV) indicator which integrates the 52-week high-low range with the Fibonacci ratio of 0.618 to calculate a dynamic equilibrium price.

Unlike the Parabolic SAR or moving averages that lag behind sharp reversals the GFV acts as a leading indicator by identifying a “gravitational center” where price extensions tend to revert. Tests across the S&P 500 and commodities like Gold show the GFV consistently signals valid bottoms before price action confirms the turn. The statistical results suggest this mean-reversion tool offers a mathematical edge over reactive trend-following methods during volatile corrections as the “GFV consistently identifies a distinct ‘fair value’ level”.

Retail investors often buy dips too early or too late; this provides a systematic framework for identifying structurally undervalued entry points during crashes.

Panchal, Anmol, Golden Fair Value: A Market Equilibrium & Correction Indicator (December 01, 2025). Available at SSRN: https://ssrn.com/abstract=6024874

Feedback

Thank you for reading this week’s edition of Recent Academic Research. Remember to fill out the poll to let me know which paper was your favorite and like the post if you enjoyed it.

Feel free to follow up with any questions, comments, or ideas for the future!

Disclaimer

The content provided in this newsletter, "Alpha in Academia," is for informational and educational purposes only. It should not be construed as financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities or financial instruments. Past performance is not indicative of future results. The financial markets involve risks, and readers should conduct their own research and consult with qualified financial advisors before making any investment decisions.

The interpretations, opinions, and analyses presented herein are those of the author and do not necessarily reflect the views of the original researchers, their institutions, or the full implications of the cited academic papers. While every effort is made to accurately represent the research discussed, readers should be aware that the summaries and interpretations may not capture the full scope or nuances of the original studies. The information contained in this newsletter is believed to be accurate and reliable at the time of publication, but accuracy and completeness cannot be guaranteed. The author and publisher accept no liability for any loss or damage resulting from reliance on the information provided.

This newsletter may contain links to external websites or resources. The author is not responsible for the content, accuracy, or reliability of these external sources.

By subscribing to or reading this newsletter, you acknowledge that you have read and understood this disclaimer and agree to hold the author and publisher harmless from any liability that may arise from your use of the information contained herein.

The REIT paper and the Chinese sector paper seem to be a little at odds, yeah? One says "add complexity via regime detection" and the other says "complexity backfires." I think a little complexity in our models is inevitable though - it does make me wonder if the real lesson is about where complexity belongs in the pipeline, not just how much.

Strong curation. The AI-PE feedback loop paper nails a systemic risk most analysts miss by treating credit and equity silos separately. That amplification mechanism where IT spending cuts loop back into tech valuations is what made 2008 so brutal when housing contagion spread beyond mortgages. The inverse variance finding for Chinese sectors is also intresting, basically confirming that sophistication collapses when estimation error dominates signal quality.