Recent Academic Research

Bond spillovers, cyber risk premia, network alpha, and a smarter way to rotate

Welcome back to another issue of Recent Academic Research! Let’s get into it.

Cyber Risk Premia

Investors demand a significant return premium for holding firms with high exposure to cyber threats.

Using advanced machine learning techniques to analyze thousands of corporate 10-K filings, this paper quantifies the “cyber risk” exposure of U.S. firms.

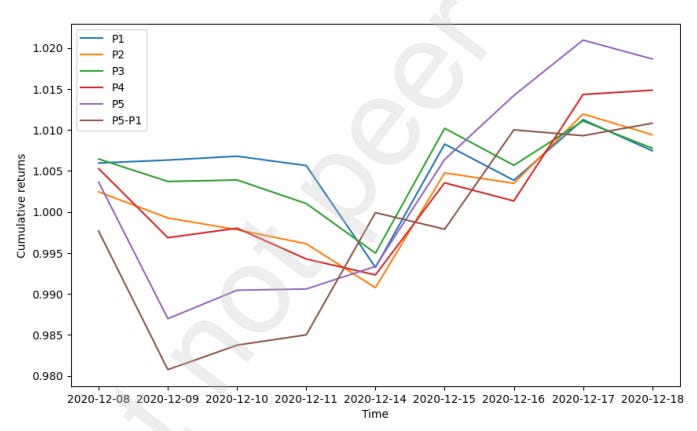

The authors identify four distinct categories of threats, ranging from data manipulation to direct impact attacks, and find that a portfolio of high-risk firms significantly outperforms low-risk ones. The portfolio with the highest quintile of cyber score risk, P5, has a statistically significant average excess return of 1.44%.

Interestingly, while the specific types of threats vary, the stock market does not seem to price these nuances separately; instead, it “views them as a single, aggregate cyber risk”. The study confirms that cyber risk is now a priced factor in asset returns, independent of standard characteristics like size or value.

Maréchal, Loïc and Monnet, Nathan, Disentangling the sources of cyber risk premia. Available at SSRN: https://ssrn.com/abstract=6173935 or http://dx.doi.org/10.2139/ssrn.6173935

Return Spillovers in Bonds

Predictability in corporate bond returns is driven largely by information spilling over from one bond to another rather than by the momentum of the bonds themselves.

This research challenges the idea that corporate bond markets efficiently process information in isolation. By developing a self-financing trading strategy, the authors decompose return predictability into two sources: a bond’s own past performance and the “spillovers” from other bonds.

They find that dynamic lead-lag relationships between bonds account for over 95% of expected profitability, with spillovers playing a dominant role in high-credit-risk portfolios.

This suggests that news regarding credit conditions gets incorporated into prices gradually, allowing savvy investors to predict a bond’s movement based on the lagged returns of its peers. The authors conclude that “spillovers account for a substantial share of profitability”.

Avramov, Doron and Jostova, Gergana and Philipov, Alexander, Return Spillovers in Corporate Bonds (January 21, 2026). Available at SSRN: https://ssrn.com/abstract=6111406 or http://dx.doi.org/10.2139/ssrn.6111406

High-Sharpe Portfolio Selection

Network theory offers a sophisticated alternative to traditional portfolio optimization by balancing structural diversification with the performance of central market hubs.

The authors propose a novel framework called Sector-Conditional Optimal Selection (SCOS) that improves upon simple diversification strategies. Rather than blindly picking “peripheral” assets that are loosely connected to the rest of the market, this method first partitions the market into economic sectors to ensure structural diversity.

Within each sector, it dynamically chooses between central “hub” assets and peripheral ones based on whether centrality is currently correlated with strong performance. This flexibility allows the portfolio to capture alpha during periods when major market movers are rallying while retreating to uncorrelated assets during stress.

The empirical tests show this method generates a robust Sharpe ratio of 1.47, “outperforming both the naive market benchmark... and the notorious MV-strategy”. This matters because it provides a practical way to construct portfolios that adapt to shifting market correlations, avoiding the pitfalls of static mean-variance optimization.

Boshoff, Louis Wilhelm Ernst and van Vuuren, Jan Harm, Beyond peripheries: A conditional, sector-based approach to portfolio selection. Available at SSRN: https://ssrn.com/abstract=6170130 or http://dx.doi.org/10.2139/ssrn.6170130

Market Cap Rotation

By applying a regime filter to market-capitalization rotation, investors can significantly enhance risk-adjusted returns while avoiding the steepest drawdowns of a buy-and-hold approach.

This study introduces a dynamic strategy that rotates capital among large-, mid-, and small-cap U.S. equity ETFs based on their relative momentum. The crucial innovation is the addition of a “regime filter” that uses the momentum of inflation-protected bonds (TIPS) as a canary in the coal mine.

When the regime is favorable, the strategy aggressively targets the strongest market-cap segment, but when the filter signals danger, it retreats to defensive Treasury bills. The results show that this dual approach captures the upside of equities while sidestepping major crashes, effectively smoothing out the volatility inherent in pure stock exposure.

The authors note that the strategy “achieves higher compound returns... and substantially reduced drawdowns” compared to a standard total market index.

Richman, Peter, A Regime-Aware Market Capitalization Rotation Strategy Using Hybrid Asset Allocation Momentum (January 18, 2026). Available at SSRN: https://ssrn.com/abstract=6096427 or http://dx.doi.org/10.2139/ssrn.6096427

Feedback

Thank you for reading this week’s edition of Recent Academic Research. Remember to fill out the poll to let me know which paper was your favorite and like the post if you enjoyed it.

Feel free to follow up with any questions, comments, or ideas for the future!

Disclaimer

The content provided in this newsletter, "Alpha in Academia," is for informational and educational purposes only. It should not be construed as financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities or financial instruments. Past performance is not indicative of future results. The financial markets involve risks, and readers should conduct their own research and consult with qualified financial advisors before making any investment decisions.

The interpretations, opinions, and analyses presented herein are those of the author and do not necessarily reflect the views of the original researchers, their institutions, or the full implications of the cited academic papers. While every effort is made to accurately represent the research discussed, readers should be aware that the summaries and interpretations may not capture the full scope or nuances of the original studies. The information contained in this newsletter is believed to be accurate and reliable at the time of publication, but accuracy and completeness cannot be guaranteed. The author and publisher accept no liability for any loss or damage resulting from reliance on the information provided.

This newsletter may contain links to external websites or resources. The author is not responsible for the content, accuracy, or reliability of these external sources.

By subscribing to or reading this newsletter, you acknowledge that you have read and understood this disclaimer and agree to hold the author and publisher harmless from any liability that may arise from your use of the information contained herein.