Recent Academic Research

Why option markets doubt the Hong Kong peg, how whales distort election odds, the R&D strategy hiding in plain sight, and the accounting signal that predicts true value creation

Welcome back to another issue of Recent Academic Research! Let’s get into it.

Prediction Market Manipulation

Large traders can distort election odds, but the market eventually fights back.

With billions of dollars flowing into political betting platforms, there is growing concern that “whales” with deep pockets can manufacture false probabilities. This study uses agent-based modeling to simulate how a market reacts when a single trader controls a massive portion of the capital.

The results show that while a whale can indeed push prices away from reality, the distortion is usually temporary because smart traders spot the mispricing and bet against it.

The duration of these false signals depends heavily on the behavior of other participants; if retail traders herd and follow the price trend, the distortion lasts longer and becomes more volatile. However, in a market with sufficient “expert” capital, the manipulation is eventually arbitraged away. This suggests that while prediction markets are generally efficient, short-term prices can be noisy artifacts of capital flows rather than pure signals of public sentiment.

Smart, B., Mark, E., Bastian, A., & Waugh, J. (2026). Manipulation in Prediction Markets: An Agent-based Modeling Experiment. arXiv preprint arXiv:2601.20452.

The R&D Factor

Accounting rules that penalize innovation might be creating a persistent market inefficiency.

Because US accounting standards force companies to expense research and development immediately rather than capitalizing it like a factory, innovative firms often look less profitable on paper than they actually are.

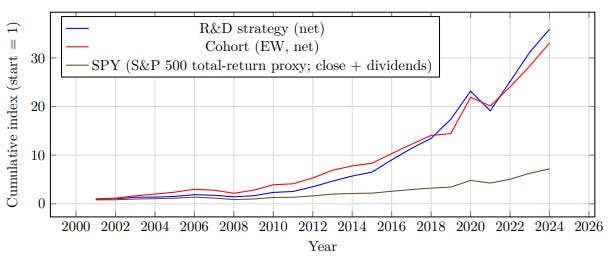

This paper exploits that disconnect by constructing a simple strategy that buys the top 20 R&D-intensive companies in the S&P 500. The authors document a consistent “R&D premium” that outperforms the broader market by over 3% annually, even after accounting for transaction costs and sector biases.

Crucially, this effect holds up across different market capitalizations, meaning it is not just a proxy for buying small, volatile tech stocks. The findings support the idea that investors consistently undervalue the long-term cash flows generated by intangible assets.

Sehgal, Abhishek, R&D Alpha: Investment Intensity and Long-Term Stock Returns (January 01, 2026). Available at SSRN: https://ssrn.com/abstract=6002295 or http://dx.doi.org/10.2139/ssrn.6002295

Predicting Corporate Value Creation

Revenue momentum is the clearest signal of corporate health.

Most financial research tries to predict stock returns, but that approach mixes actual business performance with the noise of changing market sentiment. This study isolates the signal by using machine learning to forecast “fundamental value creation” (a metric combining earnings growth, dividends, and buybacks) rather than share price.

The analysis finds that “fundamental momentum” is the single most powerful predictor of future success. Specifically, companies with accelerating revenue and volatility-adjusted earnings growth tend to keep winning operationally, regardless of how the market values them.

Investment stability also plays a major role, as firms with consistent capital deployment outperform those with erratic spending patterns.

Overby, Magnus, Which Accounting Signals Predict Future Value Creation? (January 16, 2026). Available at SSRN: https://ssrn.com/abstract=6091048 or http://dx.doi.org/10.2139/ssrn.6091048

Hong Kong Dollar Peg Stability

Option markets suggest the Hong Kong dollar’s link to the greenback is not viewed as permanent.

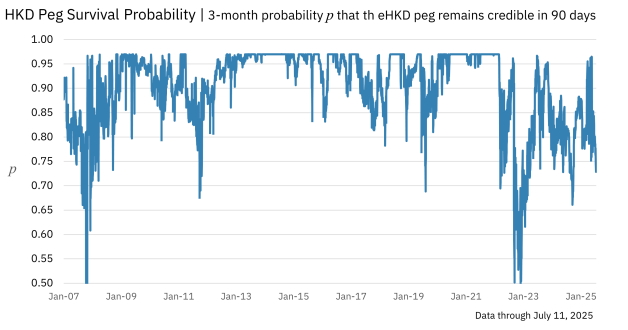

The Hong Kong dollar’s peg to the US dollar has been a cornerstone of Asian finance for decades, but new research suggests that sophisticated traders do not view it as unbreakable. By analyzing option prices rather than just the spot exchange rate, the authors build a model to quantify the “break risk” priced into the market.

They find that credibility is not static; it wavers significantly when US interest rates rise above Hong Kong rates (rate differentials) or when liquidity in the interbank market dries up.

The model identifies specific episodes of stress, such as in late 2022, where the probability of a break spiked despite the spot rate holding firm. This implies that while the peg mechanism is robust, it is not immune to the pressures of divergent monetary policies.

Jermann, Urban J. and Wei, Bin and Yue, Vivian Z., How Credible Is Hong Kong’s Currency Peg? Insights from Financial Market Prices (September 25, 2025). FRB Atlanta Policy Hub Paper No. 2025-05, https://doi.org/10.29338/ph2024-05, Available at SSRN: https://ssrn.com/abstract=6144526 or http://dx.doi.org/10.2139/ssrn.6144526

Feedback

Thank you for reading this week’s edition of Recent Academic Research. Remember to fill out the poll to let me know which paper was your favorite and like the post if you enjoyed it.

Feel free to follow up with any questions, comments, or ideas for the future!

Disclaimer

The content provided in this newsletter, "Alpha in Academia," is for informational and educational purposes only. It should not be construed as financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities or financial instruments. Past performance is not indicative of future results. The financial markets involve risks, and readers should conduct their own research and consult with qualified financial advisors before making any investment decisions.

The interpretations, opinions, and analyses presented herein are those of the author and do not necessarily reflect the views of the original researchers, their institutions, or the full implications of the cited academic papers. While every effort is made to accurately represent the research discussed, readers should be aware that the summaries and interpretations may not capture the full scope or nuances of the original studies. The information contained in this newsletter is believed to be accurate and reliable at the time of publication, but accuracy and completeness cannot be guaranteed. The author and publisher accept no liability for any loss or damage resulting from reliance on the information provided.

This newsletter may contain links to external websites or resources. The author is not responsible for the content, accuracy, or reliability of these external sources.

By subscribing to or reading this newsletter, you acknowledge that you have read and understood this disclaimer and agree to hold the author and publisher harmless from any liability that may arise from your use of the information contained herein.

Interesting result. I would want to see it sector-neutral first. If it survives that, it feels like a solid slow-moving model feature.

Sharp insight on the R&D accounting mispricing. The fact that immediate expensing creates a systematic undervaluation is textbook inefficient markets hypothesis in action. I've seen this play out with biotech companeis where massive R&D spend tanks reported profitability but the intangible asset value is ignored by tradicional valuation models. The 3% annual premium holds even across market caps, which rules out the usual small-cap volatility excuse.