Recent Academic Research

The most interesting research papers on the financial markets in the past week

Improving Momentum

Momentum trading enhanced with ranking algorithms achieves an exceptional Sharpe ratio of 3.4 in equity markets.

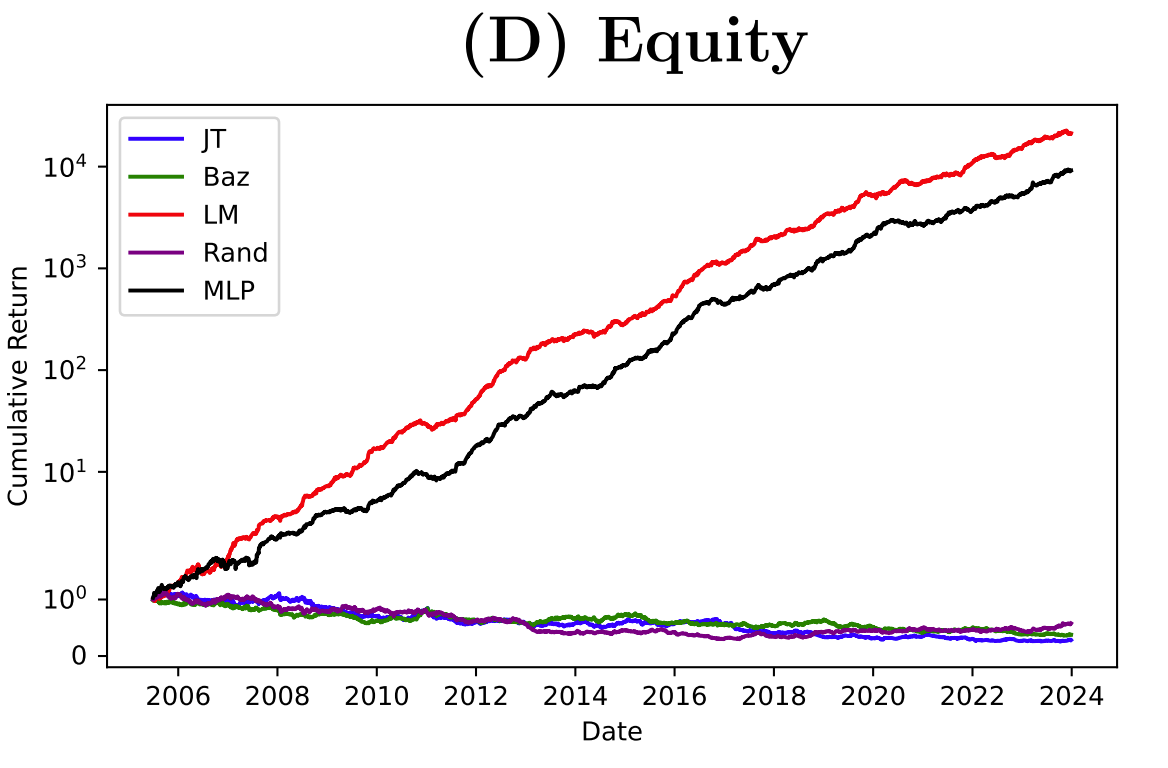

Traditional momentum strategies, which select assets based solely on past returns, often overlook the relational structure between assets. This study introduces an innovative approach using learning-to-rank (LTR) algorithms, originally popularized by search engines to rank information relevance, to enhance cross-sectional momentum trading across equities, bonds, commodities, and currencies.

Unlike standard regression methods, LTR algorithms explicitly learn the ranking relationships among assets, significantly boosting portfolio performance.

Testing the LTR algorithm LambdaMART across four asset classes from 2000-2023 reveals striking improvements, especially in equities. The strategy achieves a remarkable Sharpe ratio of 3.4, notably outperforming classical momentum (negative Sharpe) and modern neural network (Sharpe of 3.08) benchmarks.

This outstanding performance is attributed to LambdaMART's superior ability to capture intricate asset ranking dynamics. The method also consistently reduced drawdowns, enhancing risk management. Although transaction costs were not included, the significant performance gap suggests genuine enhancements. Overall, ranking algorithms show substantial promise beyond traditional momentum strategies, particularly in equity markets.

Burdorf, Tom, Learning to Rank: Enhancing Momentum Strategies Across Asset Classes (May 15, 2025). Available at SSRN: https://ssrn.com/abstract=5255258 or http://dx.doi.org/10.2139/ssrn.5255258

Nowcasting Global Trade from Space

Satellite data can predict global maritime trade in real-time with impressive accuracy, achieving correlations of 0.95 and 0.80 with official trade value and volume data, respectively.

"Nowcasting," or estimating economic indicators in real-time before official statistics become available, offers a valuable early insight into global economic activity. Researchers at the IMF have introduced an innovative nowcasting model using satellite data that tracks vessel movements to provide rapid, accurate predictions of global maritime trade.

Given that around 80% of global merchandise trade occurs via shipping, these predictions significantly enhance the timeliness and utility of trade monitoring.

The model closely mimics official statistical methods, converting raw shipping data from physical volumes into monetary values using precise unit-value measures and adjusting for price fluctuations with deflators.

This careful approach yields remarkable accuracy: monthly year-over-year predictions for global trade values and volumes correlate strongly with official data from the Netherlands Bureau for Economic Policy Analysis (CPB), at 0.95 and 0.80 respectively, and maintain a low error rate (RMSE values around 0.05 and 0.04 respectively). This means the nowcasts reliably identify major turning points in global trade, even during significant disruptions like COVID-19 and geopolitical crises.

Arslanalp, Serkan and Mo Choi, Seung and Kamali, Parisa and Koepke, Robin and McKetty, Matt and Ruta, Michele and Saraiva, Mario and Sozzi, Alessandra and Verschuur, Jasper, Nowcasting Global Trade from Space. IMF Working Paper No. 2025/093, Available at SSRN: https://ssrn.com/abstract=5263551 or http://dx.doi.org/10.5089/9798229011396.001

Dividend-Price Ratio and Future Stock Returns

The dividend-price ratio provides statistically significant but modest predictive power for short-term stock returns.

Using monthly data from the S&P 500 index from 1928 to 2017, researchers investigated whether the dividend-price ratio, a widely recognized financial indicator, could forecast stock returns.

Through a straightforward regression analysis, they found a meaningful relationship, with the dividend-price ratio explaining approximately 7.8% of the variation in monthly returns. While this level of explanatory power is relatively modest, it is still noteworthy given the longstanding debate on the predictability of stock returns.

Furthermore, this modest predictive ability held up in out-of-sample tests covering the period from 2003 to 2017, with the model achieving a reasonably low root mean square error (RMSE) of about 3.42%.

Although the predictive power isn't overwhelmingly strong, its consistency both in-sample and out-of-sample is surprising and suggests that the dividend-price ratio can provide investors with some valuable, though limited, insight into future short-term stock market performance.

Wang, Yihan, Can Dividend-Price Ratio Predict Stock Return? (March 23, 2023). Available at SSRN: https://ssrn.com/abstract=5187985 or http://dx.doi.org/10.2139/ssrn.5187985

Feedback

Thank you for reading this week’s edition of Recent Academic Research. Remember to fill out the poll to let me know which paper was your favorite and like the post if you enjoyed it.

Feel free to follow up with any questions, comments, or ideas for the future!

Disclaimer

The content provided in this newsletter, "Alpha in Academia," is for informational and educational purposes only. It should not be construed as financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities or financial instruments. Past performance is not indicative of future results. The financial markets involve risks, and readers should conduct their own research and consult with qualified financial advisors before making any investment decisions.

The interpretations, opinions, and analyses presented herein are those of the author and do not necessarily reflect the views of the original researchers, their institutions, or the full implications of the cited academic papers. While every effort is made to accurately represent the research discussed, readers should be aware that the summaries and interpretations may not capture the full scope or nuances of the original studies. The information contained in this newsletter is believed to be accurate and reliable at the time of publication, but accuracy and completeness cannot be guaranteed. The author and publisher accept no liability for any loss or damage resulting from reliance on the information provided.

This newsletter may contain links to external websites or resources. The author is not responsible for the content, accuracy, or reliability of these external sources.

By subscribing to or reading this newsletter, you acknowledge that you have read and understood this disclaimer and agree to hold the author and publisher harmless from any liability that may arise from your use of the information contained herein.