Recent Academic Research

The pricing power of IMF tone, the predictive edge of structured news, and the scarring effect of rate volatility

Merry Christmas and welcome back to another issue of Recent Academic Research! Let’s get into it.

Revised LLM Sentiment

Teaching LLMs to read news like a structured database yields significantly better trading signals than treating text as a bag of sentiment.

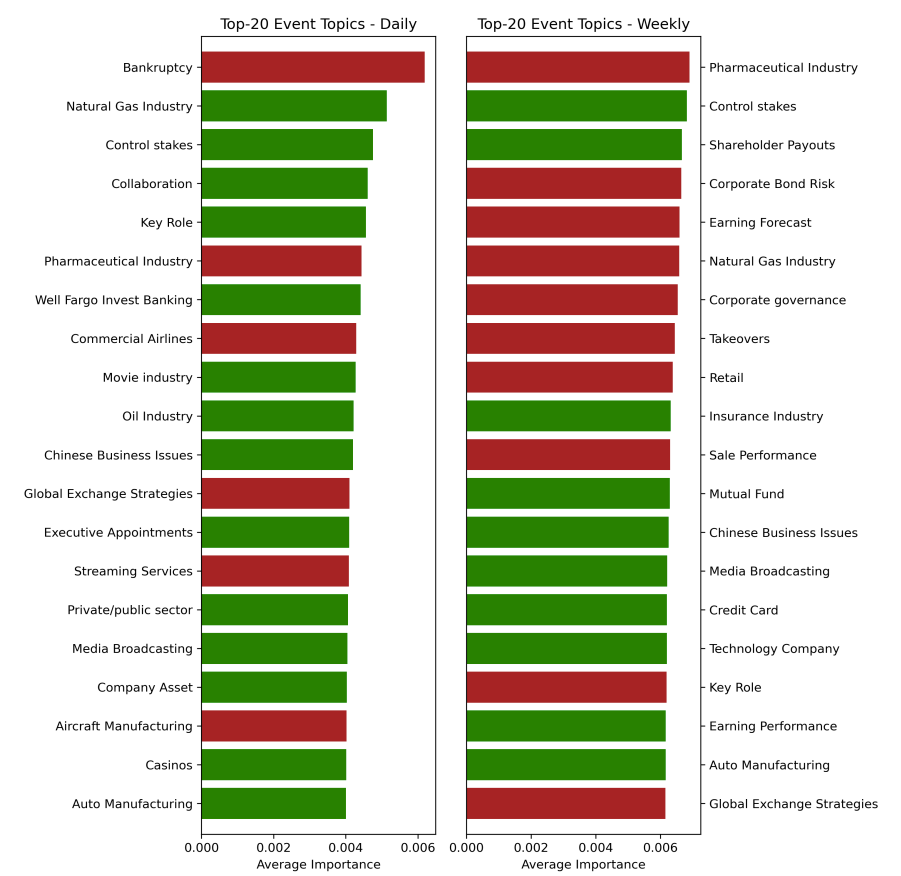

Most natural language processing in finance relies on crude sentiment scores or black box embeddings that lose the precise economic actors involved. These researchers propose a Structured Event Representation approach where an LLM forces news into a strict subject, action, object format (e.g., Apple, announces, Earnings).

By feeding these triplets into a neural network, they achieve an annualized return of nearly 11% in out of sample testing, beating traditional sentiment models which often flatline. The model reveals distinct horizons for information as bankruptcy news hits prices immediately while structural governance shifts take a week to price in.

The data shows that “structuring textual information into event representations yields markedly stronger predictive performance” compared to simply feeding raw text into a model.

Li, Gang and Qiao, Dandan and Zheng, Mingxuan, Structured Event Representation and Stock Return Predictability (December 01, 2025). Available at SSRN: https://ssrn.com/abstract=5952915 or http://dx.doi.org/10.2139/ssrn.5952915

IMF Sentiment and Sovereign Bond Spreads

IMF press releases act as powerful clarity shocks that compress sovereign risk premiums, provided the specific economic tone is right.

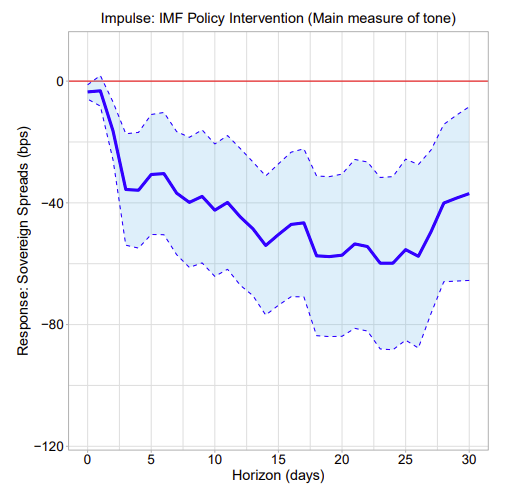

This paper tackles a classic market puzzle regarding whether official sector communication actually moves the needle for asset prices. The authors deploy a Large Language Model to parse over 600 IMF press releases, dissecting them into specific economic topics like debt sustainability and fiscal policy.

The results are striking because a one standard deviation improvement in the sentiment of an announcement correlates with a roughly 55 basis point drop in sovereign bond spreads. This effect is not uniform; it is most potent for high risk borrowers and when the text specifically addresses debt or fiscal issues.

The mechanism here is distinct from simple cheerleading; instead, the IMF provides a tangible signal that reduces “ambiguity” (Knightian uncertainty) and anchors investor beliefs. It turns out that “increase in the positivity of an IMF press release’s tone leads to a significant reduction in sovereign spreads.”

Sagna, Beatrice Maryline and Zerbo, Solo and Zerbo, Solo, Speaking to the Markets. IMF Working Paper No. 2025/258, Available at SSRN: https://ssrn.com/abstract=5961274 or http://dx.doi.org/10.5089/9798229032223.001

U.S. Monetary Policy Uncertainty and EM GDP

U.S. monetary policy uncertainty does not just cause temporary jitters in emerging markets; it permanently scars their productivity trends.

We often assume that volatility shocks are transitory events that cause short term pain before economies revert to their mean. This research challenges that view by documenting how spikes in U.S. rate volatility depress the long run GDP trend in emerging economies by about 25 basis points after three years.

The authors build a model where firms borrow against their future value to fund innovation. When uncertainty rises, forward looking firm valuations collapse, collateral constraints bind, and R&D investment dries up. Unlike advanced economies that shrug off these volatility shocks, emerging markets suffer a deflationary cycle where falling asset values tighten credit limits in a vicious loop.

The empirical evidence confirms that “shocks to U.S. interest rate uncertainty generate persistent declines in the trend of economic activity in emerging market economies.”

Nils Gornemann, Eugenio I. Rojas, and Felipe Saffie, “Volatile Rates, Fragile Growth: Global Financial Risk and Productivity Dynamics,” NBER Working Paper 34595 (2025), https://doi.org/10.3386/w34595.

Feedback

Thank you for reading this week’s edition of Recent Academic Research. Remember to fill out the poll to let me know which paper was your favorite and like the post if you enjoyed it.

Feel free to follow up with any questions, comments, or ideas for the future!

Disclaimer

The content provided in this newsletter, "Alpha in Academia," is for informational and educational purposes only. It should not be construed as financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities or financial instruments. Past performance is not indicative of future results. The financial markets involve risks, and readers should conduct their own research and consult with qualified financial advisors before making any investment decisions.

The interpretations, opinions, and analyses presented herein are those of the author and do not necessarily reflect the views of the original researchers, their institutions, or the full implications of the cited academic papers. While every effort is made to accurately represent the research discussed, readers should be aware that the summaries and interpretations may not capture the full scope or nuances of the original studies. The information contained in this newsletter is believed to be accurate and reliable at the time of publication, but accuracy and completeness cannot be guaranteed. The author and publisher accept no liability for any loss or damage resulting from reliance on the information provided.

This newsletter may contain links to external websites or resources. The author is not responsible for the content, accuracy, or reliability of these external sources.

By subscribing to or reading this newsletter, you acknowledge that you have read and understood this disclaimer and agree to hold the author and publisher harmless from any liability that may arise from your use of the information contained herein.