Recent Academic Research

Impact of FOMC meetings on currency markets, the use case of bond factor momentum in equity returns, and riding market bubbles

FX Vol and Returns Around FOMC Meetings

Currency option markets systematically price in elevated risk before FOMC meetings, creating both a volatility premium and a predictable return drift.

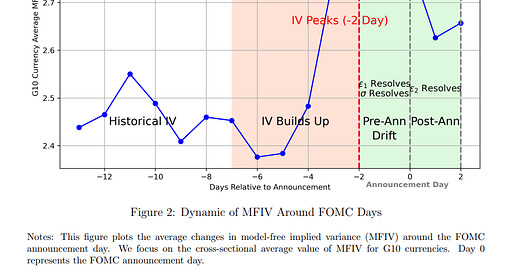

The paper explores how G10 currency options reflect investor expectations around FOMC announcements. Implied volatility begins to rise about one week before the meeting, with a sharp acceleration two to three days prior. This buildup is not random. It is systematically priced into options, creating a premium for holding volatility.

Beyond volatility, the authors uncover a pre-announcement drift in spot FX returns, especially in high interest rate currencies. This drift is partially predictable using information from options markets. Interestingly, the risk premium is larger when market uncertainty is high or when the FOMC has more information than the public.

The paper also rules out alternative explanations such as hedging pressure or liquidity shocks. Instead, the findings point to compensation for bearing monetary policy uncertainty. These results show that scheduled FOMC meetings create not just volatility events but also systematic pricing patterns in both options and spot FX markets.

This paper draws similar conclusions to that of my investigation on FX returns and volatility around FOMC meetings. The code for the investigation is available to paid subscribers.

Lin, Jiawei and Taylor, Mark P. and Wang, Zhe and Xu, Qi, FOMC Announcement Premia in Currency Markets (May 01, 2025). Available at SSRN: https://ssrn.com/abstract=5237922 or http://dx.doi.org/10.2139/ssrn.5237922

Bond Factor Momentum for Stock Returns

Bond factor momentum not only exists but outperforms across multiple lookback horizons, with short-term momentum delivering the most consistent gains.

This paper investigates whether momentum effects exist across corporate bond factors and whether these bond factor returns can help forecast stock market behavior.

Using a dataset of over 400 long–short corporate bond factors, the authors show that momentum strategies (ranking factors by past performance and going long the top quintile while shorting the bottom) deliver strong returns. The best results come from short-term lookbacks, particularly the three-month horizon.

The factors with the greatest average bond-to-stock spillover alpha include credit spread, bond yield, and rating.

Beyond strong bond returns, the study finds predictive power for equity markets. When bond factor momentum is high, future equity returns tend to be lower, suggesting that investors are crowding into bond factors when risk appetite is reduced. The relationship holds even after controlling for macro variables and equity factor trends.

Keshavarz, Javad and Sirmans, Stace, Bond Factor Momentum and Its Predictability for Stock Returns (April 23, 2024). Available at SSRN: https://ssrn.com/abstract=5242278 or http://dx.doi.org/10.2139/ssrn.5242278

Riding the Market Bubble

Market timing strategies that ride bubbles can outperform significantly, especially when using signals that detect acceleration in price growth.

This paper examines whether traders can profitably time markets during bubbles without knowing fundamental values or predicting exact peaks. The authors test a set of simple rules that identify when a bubble is accelerating and recommend staying invested during the growth phase while exiting early once prices start to slow.

These rules are based on return acceleration and momentum rather than valuation, allowing strategies to ride price trends instead of fighting them. The surprising result is that such timing models consistently outperform both buy-and-hold and traditional trend-following benchmarks, especially during the largest historical bubbles.

The authors emphasize that early exits drive most of the outperformance, suggesting that even irrational market behavior can be systematically traded. Rather than fearing bubbles, investors may benefit from watching for signs of overheating and exiting decisively once the upward momentum begins to crack.

Jarrow, Robert A. and Kwok, Simon, Riding a Bubble: A Study of Market-Timing Trading Strategies (March 31, 2025). Cornell SC Johnson College of Business Research Paper Forthcoming, Available at SSRN: https://ssrn.com/abstract=5200953 or http://dx.doi.org/10.2139/ssrn.5200953

Feedback

Thank you for reading this week’s edition of Recent Academic Research. Remember to fill out the poll to let me know which paper was your favorite and like the post if you enjoyed it.

Feel free to follow up with any questions, comments, or ideas for the future!

Disclaimer

The content provided in this newsletter, "Alpha in Academia," is for informational and educational purposes only. It should not be construed as financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities or financial instruments. Past performance is not indicative of future results. The financial markets involve risks, and readers should conduct their own research and consult with qualified financial advisors before making any investment decisions.

The interpretations, opinions, and analyses presented herein are those of the author and do not necessarily reflect the views of the original researchers, their institutions, or the full implications of the cited academic papers. While every effort is made to accurately represent the research discussed, readers should be aware that the summaries and interpretations may not capture the full scope or nuances of the original studies. The information contained in this newsletter is believed to be accurate and reliable at the time of publication, but accuracy and completeness cannot be guaranteed. The author and publisher accept no liability for any loss or damage resulting from reliance on the information provided.

This newsletter may contain links to external websites or resources. The author is not responsible for the content, accuracy, or reliability of these external sources.

By subscribing to or reading this newsletter, you acknowledge that you have read and understood this disclaimer and agree to hold the author and publisher harmless from any liability that may arise from your use of the information contained herein.

You likely receive hundreds of pitches.

This isn’t one of them.

Hello @Alpha in Academia,

Share deep respect for your work.

I am the Founder and Steward of the 100x Farm.

The 100x Farm is a quiet strategy sanctuary for investors and capital stewards with long memories and longer horizons.

No noise. No dopamine. No trend-chasing.

Just deep-cycle clarity earned slowly, shared rarely.

We don’t believe in inbox conquest.

But if the idea of sowing $10,000 seeds to harvest $1 million trees over 20- 30 years feels familiar,

you and your patrons may already belong here.

What if the next 100x isn’t a stock but a forgotten business model hiding in plain sight?

Every thesis is backed by real capital, filtered through over 100 long-cycle lenses before it earns a word.

And if nothing else, this may help you filter what isn’t worth your time.

No urgency. No ask.

Only signal.

Should you, or your patrons, choose to engage, our farm door remains open.

Warmly,

The 100x Farmer